Recent changes to tax laws make it more likely that corporations will generate taxable income and have a corresponding need to offset that taxable income with tax attributes such as net operating losses (NOL), business interest, and tax credits. If a loss corporation experiences one or more ownership changes, its ability to use pre-change NOLs may be limited.

To determine if these tax attributes are available to use, an Internal Revenue Code (IRC) Section 382 analysis is required.

Section 382

Under Section 382, an ownership change occurs when the ownership held of shareholders of the loss corporation increases by more than 50 percentage points within a three-year period. If such a change occurs, the corporation's ability to use any pre-change NOLs each year is limited to the value of the corporation's stock immediately before the ownership change multiplied by the applicable long-term tax-exempt rate—the Section 382 limitation.

There are many complexities regarding the application of Section 382 and resulting limitations on the use of NOLs and other tax attributes, including the application of Section 382 for federal versus state income or franchise tax purposes. To determine how Section 382 can impact you and the availability of your tax attributes, professional guidance is always recommended.

Section 382 and Federal Income Taxes

The following discussion relates to federal income taxes, and the application of Section 382 to state income and franchise tax should be evaluated separately.

Understand Recent Issues Related to Section 382

Recent tax law changes accelerated the need for corporations to consider analyzing the implications of Section 382, particularly for corporations that:

- Are more likely to generate taxable income because of the changes to the IRC Section 174 capitalization rules for research and experimental (R&E) expenditures and the absence of tax deductions that create a need to utilize NOLs to offset taxable income

- Use NOLs generated in tax years starting before January 1, 2018, to fully offset taxable income as opposed to only 80% of taxable income with NOLs generated in tax years starting after December 31, 2017

- Experience a more restrictive IRC Section 163(j) limitation on the deductibility of its interest expense and accumulating these interest carryforwards subject to Section 382

- Rely heavily on the increase to the Section 382 limitation from built-in gains in their assets under the IRC Section 338 approach of Notice 2003-65

Section 174 Capitalization

Companies with a material amount of specified research or experimental (SRE) expenses, including software development costs—now explicitly included as SRE expenses—must presently capitalize and amortize SRE expenses over five or 15 years starting for tax years beginning after December 31, 2021.

Although there has been recent consideration by Congress to repeal or revise these new capitalization rules, the need to understand the potential Section 382 limitations on a corporation’s NOLs will continue regardless of the underlying causes that require future NOL utilization.

For tax years beginning before January 1, 2022, companies could generally deduct R&E expenses in the year incurred. Deducting large amounts of R&E expenses enabled corporations to generate substantial losses, generating NOL carryforwards, and allowed corporations that invested heavily in R&D to avoid generating taxable income.

Corporations that historically generated tax losses are now generating significant taxable income as a result of these changes, creating the need to access NOLs and tax credits to offset taxable income and tax liability, respectively.

These corporations may not be accustomed to experiencing a tax liability created from net taxable income. Therefore, corporations with NOLs and other tax attributes should consider performing a Section 382 analysis well in advance of any tax return filing deadline to avoid surprises and unnecessary complications.

Changes in NOLs

As a result of the Tax Cuts and Jobs Act (TCJA), NOLs generated in tax years beginning before January 1, 2018, can be carried forward 20 years when the NOLs eventually expire if unused. NOLs generated in tax years beginning after December 31, 2017, don’t expire, but can only offset 80% of a corporation’s taxable income.

Pre-TCJA NOLs aren’t subject to the 80% limitation rule and can still fully off-set a corporation’s taxable income to the extent such NOLs are otherwise available, assuming no limitation under Section 382.

As a result, a corporation’s pre-TCJA NOLs may be more valuable in potentially offsetting a corporation’s taxable income.

When a corporation utilizes its NOL carryforwards to offset its taxable income, a corporation can’t choose which it uses. NOLs are generally used on a first in, first out basis so long as the NOLs are not otherwise limited under Section 382. If a loss corporation has both pre-TCJA NOLs and post-TCJA NOLs—assuming no other limitations exist—the pre-TCJA NOLs are used first and can fully offset taxable income. Once the pre-TCJA NOLs are fully utilized, the corporation taps into its post-TCJA NOLs to offset the remaining taxable income, subject to the 80% limitation.

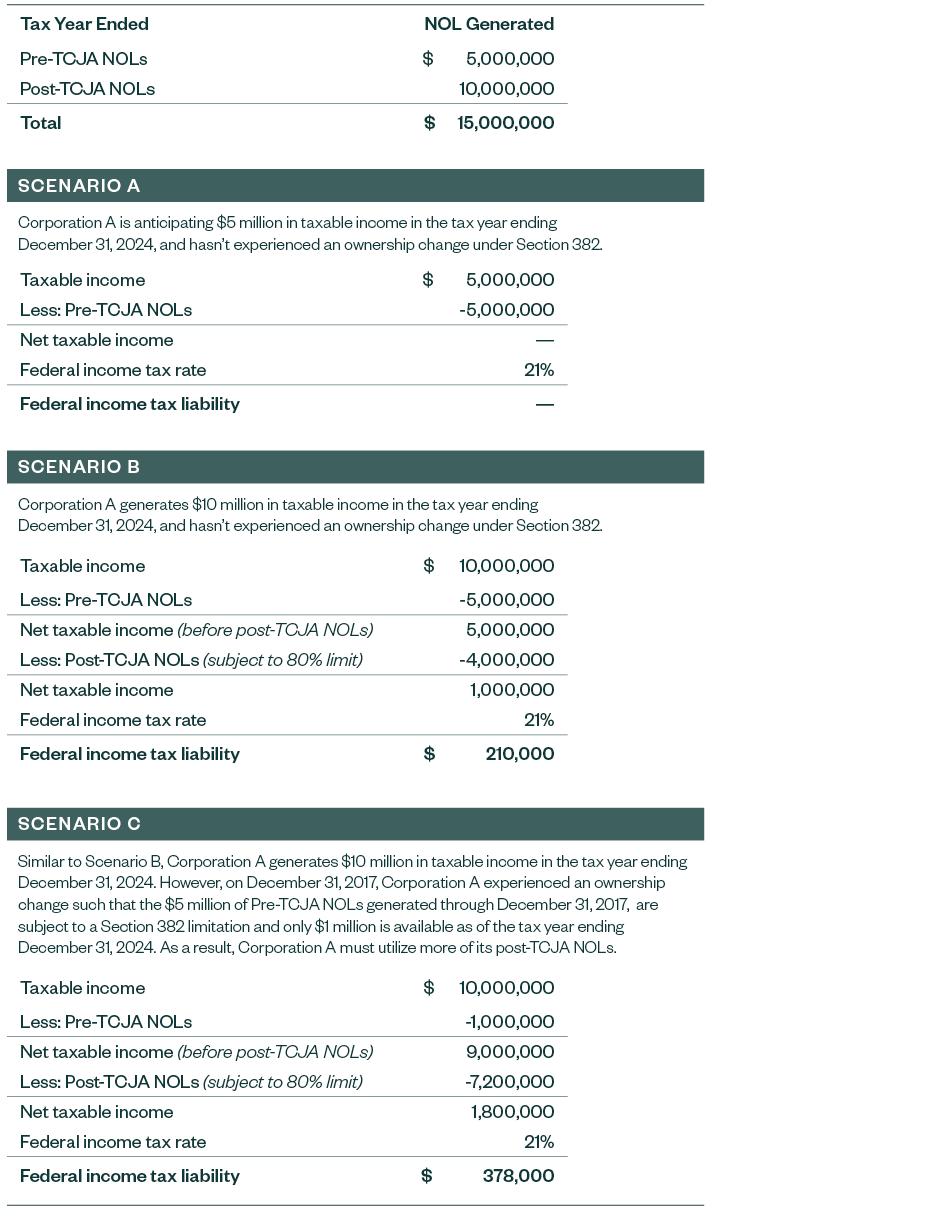

For example, assume that Corporation A had the following NOLs generated:

As illustrated in the above examples, a corporation’s pre-TCJA NOLs are generally more valuable and can provide more cash-tax savings than post-TCJA NOLs in a given tax year. In this scenario, the pre-TCJA NOLs would result in cash tax savings of $168,000. This additional value, however, can only be monetized to the extent such pre-TCJA NOLs are available for utilization and aren’t limited under Section 382.

Since corporations often experience various equity events, including stock issuances, repurchases, and transfers throughout their lifetimes that create owner shifts, pre-TCJA NOLs generally have a greater likelihood of being subject to potentially restrictive Section 382 limitations.

Without a formal Section 382 analysis, it’s often challenging to confirm the availability of the corporation’s NOLs. Considering recent tax law changes, an analysis is especially important in most cases to confirm the availability of pre-TCJA NOLs.

A corporation using only a small amount of recently generated NOLs might be tempted to shortcut a Section 382 analysis. However, this approach is typically not recommended except in limited scenarios and can create a trap for the unwary due to the complexities of Section 382.

The 80% utilization limitation rule creates an additional reason for a corporation to perform a complete Section 382 analysis to ensure all potential Section 382 limitations on the use of pre-TCJA NOLs and post-TCJA NOLs are accounted for and considered.

Finding the Right Balance Between IRC Section 163(j) and Section 382

Effective for tax years beginning after December 31, 2017, business interest expense is generally limited to 30% of adjusted taxable income but the disallowed deduction is allowed as a potential tax benefit in the form of a carryover to be used as a tax deduction in future tax years. The limitation has resulted in more corporations generating disallowed business interest expense carryforwards.

Business interest carryforwards are treated as tax attributes subject to limitation under Section 382, similar to NOLs. As a result, some corporations which previously didn’t have to apply Section 382 as they had no NOLs or credits, are now needing to analyze any Section 382 impact. In addition, corporations which have NOLs, credits, and business interest carryforwards must consider how these rules and limitations overlap.

Some considerations when simultaneously dealing with Section 382 and Section 163(j) are as follows:

- Section 382’s ordering rules provide that applicable Section 382 limitations will free up business interest carryforwards prior to NOLs and other tax attributes.

- If a Section 163(j) limitation allows a corporation to use business interest carryforwards, then any applicable Section 382 limitation may be consumed by the allowance of business interest carryforwards and limit or prevent the utilization of NOLs or other tax attributes.

- If, however, a Section 163(j) limitation restricts a corporation from utilizing its business interest carryforwards, then any applicable Section 382 limitation would allow the corporation to instead utilize its NOLs or other tax attributes.

The variability on a corporation’s business interest expenses, applicable Section 163(j) limitations, and potential Section 382 limitations on a tax-year by tax-year basis often makes it more challenging for a corporation to assess when and how many tax attributes may be available for utilization in future tax years.

Work with your tax advisor to keep your Section 382 analysis updated for tax attribute availability.

Proposed Section 382 NUBIG(L) Regulations

If a loss corporation experiences an ownership change under Section 382, the Section 382 rules apply an annual limitation on the availability of the corporation’s pre-change NOLs to offset post-change taxable income.

In general, the annual Section 382 limitation is equal to the value of the corporation immediately before the ownership change, subject to possible adjustments, multiplied by the applicable federal rate. In addition, if a corporation has a net unrealized built-in gain (NUBIG) in its assets immediately prior to the ownership change, the annual limitation can potentially be increased significantly as permitted under the Section 338 approach under IRS Notice 2003-65.

Proposed Changes

In 2019, the IRS and Treasury released Proposed Treasury Regulation Section 1.382-7 that would have eliminated this benefit under the IRC Section 338 approach. In 2020, the IRS and Treasury released transitional guidance that states the final regulations will be applicable 30 days after publication, and that taxpayers are still able to rely on the methods described under IRS Notice 2003-65 until then.

The proposed regulations received significant criticism by tax professionals who said the elimination of the Section 338 approach is too harsh, punishes loss corporations and the regulations were never finalized.

Many tax practitioners anticipate the IRS will eventually propose new treasury regulations that curtail the current benefit upon applying Notice 2003-65 to increase the annual limitation on the amount of available NOLs and other tax attributes, even if the new proposed rules aren’t as restrictive as the original 2019 proposed rules.

The IRS says these rules should be released in the future. Like the proposed rules in 2019, any newly proposed rules aren’t likely to apply retroactively, but rather only prospectively to ownership changes after the rules’ effective date.

Corporations should watch for rule changes as any future ownership change could make the availability of NOLs or other tax attribute carryovers subject to significantly more restrictive annual Section 382 limitations to offsetting future taxable income and tax liability.

We’re Here to Help

To learn more about navigating the complexities of Section 382, contact your Moss Adams professional.